Become a NuLegacy Share-Millionaire

~ NuLegacy Updates Private Placement Closing ~

~ Please contact me if you wish to discuss – albert@nuggold.com ~

To NuLegacy Shareholders/Stakeholders:

Good day Folks,

From investment banking/stock brokerage to exploration, a steep learning curve: Fortunately, we had the leadership of an old acquaintance who, during the course of the last two decades of investing/speculating in Nevada, has become a dear friend, Dr. Roger Steininger.

Roger has steered us well on numerous occasions; thus, we had a leg up in choosing properties...and people...and adventures...and he is the reason NuLegacy has the Red Hill property.

13 years later, NuLegacy’s team is on the leading edge of developing and understanding Carlin gold systems, and we believe the Red Hill is the premier gold prospect in Nevada.

When Roger first introduced the Red Hill property (2009), he said, “If you have seen one or been part of the discovery of one of these seven major Carlin systems, you know a little about one Carlin system.”

Characteristics: Today, through the evolution of NuLegacy’s geo-team we have been able to determine/advance the understanding of Carlin-gold systems sufficiently to suggest there are really three, possibly four characteristics/ways that gold can/is emplaced in Carlin systems - and be able to distinguish them and establish discrete techniques to search for them:

1. Hanging wall antiforms associated with thrusting; thrusts are typically blind below master thrust faults.

2. Structural intersections:

a. Structural intersections in favorable host rocks; these can be intersecting high angle faults, or high and low angle faults. Red Hill is strongly faulted, with both high and low angle faults and multiple known host horizons (principally Wenban5 and several more). A subset is the above within a metamorphic aureole.

b. Structural intersection or antiform fold within metamorphic aureole beneath intrusive overhang.

Our experience at the Red Hill has been “high grade or low grade in nearly every hole”...virtually no holes with no grade…it takes a powerful Carlin-gold-system to generate that much gold “smoke.”

Everywhere we have drilled, we have come up with gold...either in small quantities (low grade) over significant intervals (i.e. 69 meters of 0.5 grams/t) or significantly high grades (25 to 40 grams/t) over shorter intervals...enough of both of these to strongly indicate “There’s gold in them thar hills...”

One of these opportunities is located in the Midrift anticline! “Numerous structural intersections in favorable host rocks.”

We have continuously improved our exploration team…to the point where it is considered, by numerous industry participants, to be the very best in NV (and thus in the world) for Carlin systems; we believe it is second to none...not even to Barrick Gold, because it includes several of the team that helped Barrick find 50+ million ounces of gold in the Carlin and Cortez trends!

The whole team listed at this link (https://nulegacygold.com/team/) includes:

- Our Chairman, Mr. Alex Davidson, who, as the Executive Vice-President of Exploration and Corporate Development for Barrick for many years, was responsible (through his VP NA Exploration, Ed Cope, also a retired director of NuLegacy) for the development of the geo-team that found those 50 millions+ ounces of gold for Barrick in Nevada and elsewhere (SA), as well as the acquisition and integration of numerous companies (such as Hemlo, Homestake, Williams, Arequipa, etc.)

- Our Cofounding director, Dr. Steininger, is credited with the discovery of the Pipeline deposit (21 million ounces and counting) amongst other deposits,

- Our Exploration Manager, Charles Weakly, with numerous Carlin-style deposit expansions to his credit, is refining our targeting to the point that,

- Our Consulting team leader, Ms. Nancy Richter (former senior exploration manager for Barrick Gold) with numerous discovery credits, commented that, with this next set of holes,

“We should hit a discovery hole or be close enough that the alteration and geochemical analysis from that hole will vector us in the right direction.2”

Financing Context: Regrettably, right now, many of the institutional investment fund managers that supported us (the junior exploration industry) enthusiastically in January 2021, when we raised the C$12.5 million for the very exploration program/s that have brought us to this advantageous position are now between a rock and a hard place.

Just as junior exploration companies are producing a plethora of fine results3, and their stocks are likely bottoming out in response to the peak in rising interest rates/anticipation of a recession, some of the institutions are suffering from redemptions...and so they aren’t able to add, or be seen adding to their positions... even at these historically low almost “going out of business” like prices...

So, at the moment, individual investors have an advantage – they can be bold in the face of this distress and the pending Nov/Dec 2023 tax selling by buying the juniors on the weakness. NuLegacy Gold got out in front of much of the tax selling4 in preparation for the current Private Placement.

Fortunately for NuLegacy we have several long-time principal associations, Crescat Capital being one, that are fairly inured from the present dilemma by virtue of their success in capitalizing on the Lassonde curve, as well as on their highly developed understanding of the business/financial cycles. To my knowledge, Crescat Capital is one of the first major mining investment funds to explicitly incorporate the Lassonde concept as part of several other successful strategies in its investment/disinvestment decisions5. Having participated in the discovery rise of a number of highly successful juniors and used the guidance of the curve, as well as its highly developed understanding of the business and market cycles6, Crescat is weathering the current price oppression from the Fed better than many of its competitors, and thus able to support its investees during this critical time.

So, how can you help NuLegacy: “Become a NuLegacy share-millionaire”! The principals of NuLegacy have demonstrated their commitment to the fall drilling targets/program by subscribing to 16.1 million Units of this private placement.

Join us in the NuLegacy “share-millionaire” club7:

- At one time there were 27 individuals who had “bragging rights” to membership, and 7 or 8 corporations/institutions; membership is now cheaper than it’s ever been.

- Whether you start with owning none or a few NuLegacy shares...you too can easily become a “NuLegacy Share-millionaire”:

- Starting with none – subscribe for 500,000 Units (one share and one warrant) at C$ 2.5 cents (~US$ 1.9 cents) for a total investment/speculation price of C$12,500 (~US$ 9,260) and “if, as and when” NuLegacy’s drilling program produces useful results, exercise the warrants, and end up a NuLegacy “share-millionaire.”

- If you already have some NuLegacy, subtract that amount from 1 million, divide that by 2 and multiply by C$ 2.5 cents (by US$ 1.9 cents), and voila, you are on your way to becoming a NuLegacy share-millionaire.

Why become a NUG share-millionaire member - what are the benefits:

1. Exposure to the possibility of discovering an elephant sized Carlin-style gold deposit in this round or potentially the next round of drilling,

2. Indirect ownership in one of the best located prospective gold properties in NV, and thereby in the world,

3. The possibility of a mid-tier gold producer and/or exploration company providing funding and additional expertise by way of either financing, joint-venture, or outright purchase,

4. Get an option on gold - the 2% royalty that NuLegacy holds on the Red Hill property has the potential of becoming very valuable if, as and when a gold deposit is found.

What are the risks: see endnotes below.

Quick note on an item in yesterday’s news release: “The TSX Venture Exchange has granted the Company an extension to complete the Offering until November 26, 2023”

Why did we ‘Extend - to protect’: Extending the period during which we can offer the Units at the current price may be an excess of caution – it helps protect potential longstanding retail investors from any sudden price increase in the underlying stock.

Since we started this financing (Sept 12th), another war has broken out which naturally concerns people and distracts everyone’s attention from investing in junior mining exploration....so we have not reached all our existing shareholders.

While it may appear overly ambitious to be concerned about protecting the purchases at Cdn 2.5 cents per unit, especially as we were trading a Cdn 1.5 cents when we initially announced the placement, we are now trading at Cdn 2.5+/- cents. We wish to ensure that long-time supporters/shareholders have the opportunity to participate. If history is any guide, institutions that are interested will wait until the last minute as they rightly do not want us using/bragging on their commitments to market the rest!

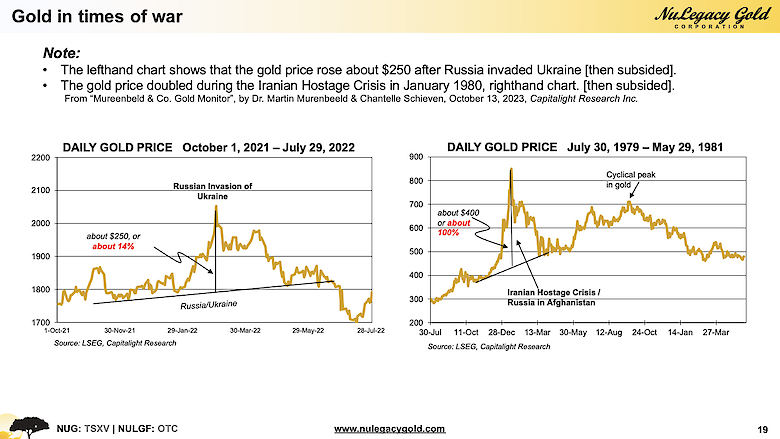

Quick note on gold during most wars. As Nathanial Rothschild is reputed to have said,

“Gold goes up on the drums of war, down [eventually] when the cannons roar”...as cannons cost gold.

The hesitation is...that the recent up move was “war induced”...and thus will retreat on peace breaking out...and what are the chances of that...I would say pretty good??

However, my view is that gold actually bottomed in late Sept/early October (during which time I bought my “first half” positions in my favorite producers) ...before the Hamas attacked Israel...and the war drums and cannon added fuel to the gold price rise...I expect the give back will be minimal...and will be the signal it’s time to get the second half.

I believe the current move in gold is real and gold stocks will enjoy a traditional “Spring rise” in values, as results and optimism have their way with the markets.

Thanking you and cheers,

Albert J. Matter

CEO, Director

NuLegacy Gold Corporation | NUG:TSXV | NULGF:OTCQX

C: 604.512.7003 | albert@nuggold.com | www.nulegacygold.com

1 This CEO Chat does not constitute an offer to sell or the solicitation of an offer to buy any security, is not intended to be relied upon as advice to investors or potential investors and does not constitute a personal recommendation or take into account the investment objectives, financial situation or needs of any particular investor. NuLegacy strongly recommends that investors or potential investors consult with their personal investment advisors before investing in any securities including Units of NuLegacy.

2As these are RC (reverse circulation) holes, gold assays usually take 4 to 6 weeks from submission, and geochemical analysis an additional 30 days.

3Impressive drill results from amongst others New Found Gold, Snowline, Southern Cross, etc.

4https://nulegacygold.com/investors/faq/

5The Lassonde Curve is conceptual in nature and not necessarily indicative of NuLegacy’s future potential value or discovery success.

6Link to one of Crescat’s discussions: https://www.youtube.com/watch?v=0QofRgn-MZg&t=2060s

7See footnote 1 above.

Dr. Roger Steininger, a Director of NuLegacy, is a Certified Professional Geologist (CPG 7417) and the qualified person as defined by NI 43-101, Standards of Disclosure for Mineral Projects, responsible for approving the scientific and technical information contained in this CEO Chat and any attached links. The foregoing chat (including the attached links) is not to be relied upon as advice to investors or potential investors and does not constitute an offer to sell or the solicitation of an offer to buy any security in the United States or any other jurisdiction in which such offer or solicitation would be unlawful. The Company’s securities are not and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”), or any state securities laws and may not be offered or sold within the United States or to or for the account or benefit of a U.S. person (as defined in Regulation S) unless registered under the 1933 Act and applicable state securities laws or an exemption from such registration is available. In addition, the foregoing contains forward-looking statements and information, which relate to future events or future performance and reflect management's current expectations and assumptions based on information currently available to the Company. Readers are cautioned that these forward-looking statements are neither promises nor guarantees and are subject to numerous risks and uncertainties (see the Company’s continuous disclosure documents filed on www.sedarplus.ca) that may cause future results to differ materially from those expected. These forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances, save as required by applicable law. As such, readers should not place undue reliance on forward-looking statements and information.

RISKS:

1. These Units are highly speculative due to the nature of NuLegacy’s business and its formative stage of development and involve significant risk. You could lose your entire investment.

2. NuLegacy is in the business of exploring for gold in Nevada, U.S.A., the success of which cannot be assured. The degree of risk increases substantially where property interests are in the exploration, as opposed to the development stage. The Red Hill property is in the exploration stage and there are no known mineral resources or reserves on the Red Hill property.

3. The presence of gold deposits on properties adjacent or in close proximity to the Red Hill property is not necessarily indicative of the gold mineralization on the Red Hill property and NuLegacy’s proposed exploration program is an exploratory search for ore.

4. NuLegacy has no history of revenues or earnings and has no present intention to pay any dividends on its common shares.

5. This list of risks is not exhaustive. Please refer to NuLegacy’s continuous disclosure filings available on SEDAR+ at www.sedarplus.ca for further discussion of the risks and uncertainties facing NuLegacy. An investment in the Units currently being offered by NuLegacy should only be considered by those investors who are able to make long-term investments and who can afford the loss of their entire investment. Investors or potential investors should consult their own professional advisors to assess the investment, income tax, legal and other aspects of the Units.