'NOT YOUR AVERAGE CARLIN-TYPE DEPOSIT'!

If you've seen one Carlin-type deposit, you've not seen them all. Like most things on earth, each one has its own distinctive characteristics up close.

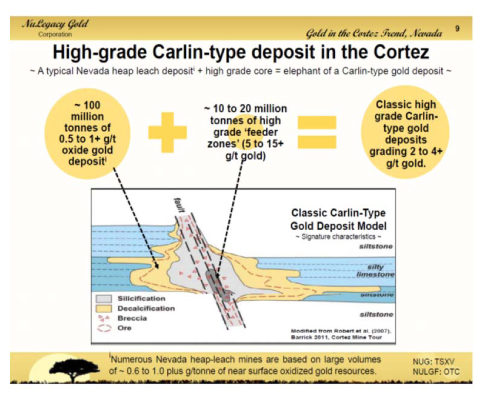

However, from 25 miles up they do look somewhat the same so if you say it fast enough, 'the typical economic low-cost (both in capital and operating cost) Nevada open pit heap leach mine is a sea of ½ to 1 gram/tonne ore'.

What does that mean? And what distinguishes the Carlin-type deposits found in the last century in the Carlin trend, and more recently in the Cortez trend, from the 'typical'?

First, the 'typical' low-cost open-pit heap-leach mine (and the Carlin-types) consists of that 'sea of 1/2 to 1 gram' oxide ore and lies somewhere from near-surface down to a maximum depth of 750 feet below the surface, otherwise it will be a higher cost underground mine

While the Cortez's Carlin-type deposits have the same 'sea of 1/2 to 1 gram material' they also have 'chunks' of much higher grade distributed within the 'sea of low to medium grade (1/2 gram to 1 gram/tonne) material'.

And these high grade 'chunks' range from as little as 5% of the volume to as much as 20%, and vary in grade from 5 grams/tonne to 35 grams/tonne. Obviously you don't need much of the 35 gram/tonne material to move the needle of a deposit's grade from a modestly economic 1/2 to 1 gram to a very profitable 2 to 4 grams...and thus the coveted Carlin's in the Cortez!

If finding a typical Nevada heap leachable mine is like looking for the proverbial needle in the haystack, finding the chunks of high grade 'core' (known in the trade as "high angle fracture zones") is like finding the eye of the needle in the dark with no feeling in your fingers.

Of course 'hunting for these Carlin elephants' is best done in a neighbourhood of 'haystacks' known to host them --- hence NuLegacy's opportunistic acquisition in the Cortez trend during the Crash of '08.

Why low cost?

|

There's the obvious lower cost of an open pit mine versus underground mine: mining with big shovels and large trucks, |  |

| ...as opposed to digging your way underground and extracting with explosives and small trams. |  |

|

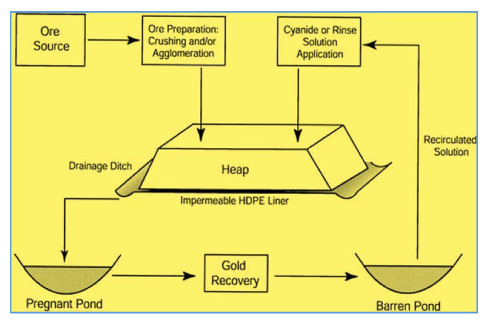

Then there's the very low capital and operating costs of simply trucking the ore to a 'pad' and sprinkling the ore with a very dilute solution of cyanide in water to recover the gold.

If you walk through this flow-sheet for a heap-leach operation, you'll see how simple the recovery process is. Just 'wash, rinse and repeat, you sprinkle with dilute solution, recover the gold, and recirculate the solution.

This is significantly cheaper than processing a sulphide ore, which requires a mill, roaster and autoclaves. It can cost half a billion dollars for several of these custom-made 'toasters' to roast the ore from an underground mine!

Contrast that with ~ $100 million dollars for off-the-shelf shovel loaders and trucks (Fig. 1), a $20 million gold recovery system (Fig. 2), and the impermeable pads and a sprinkling system (Fig. 3) for a heap-leach operation.

Conclusion:

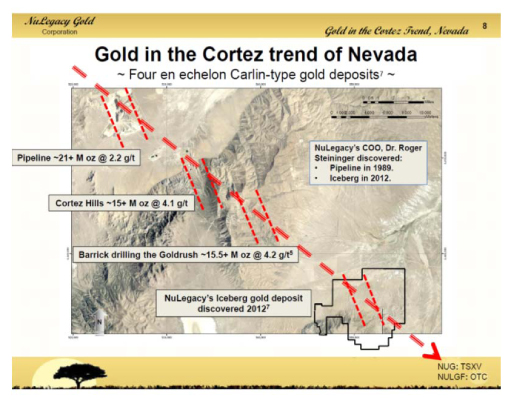

It is significantly cheaper, both in initial capital costs and final operating expenses (by as much as 1/5th or more) to mine, process and extract gold from a classic Carlin-type near- surface open-pit oxidized ore heap-leach mine (such as the Pipeline mine that NuLegacy's COO, Dr. Roger Steininger discovered in the Cortez trend) than mining and processing from a deep underground sulphide mine.

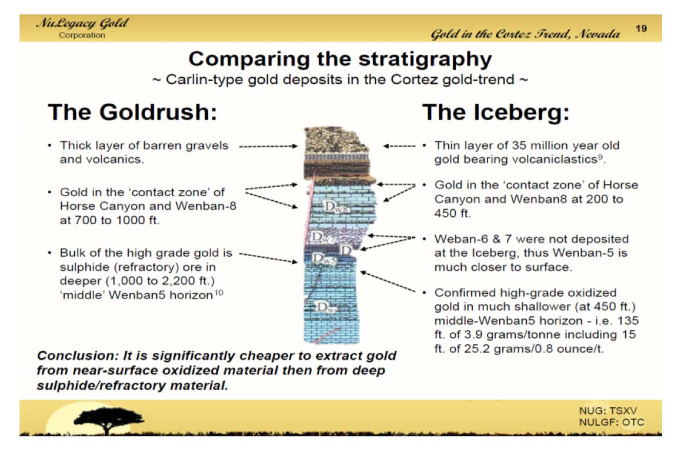

As illustrated by the following comparison, the gold bearing zones in NuLegacy's Iceberg deposit are much nearer surface when compared to Barrick's adjacent Goldrush deposit. And the Iceberg's mineralization is oxidized whereas the bulk of the Goldrush's ounces (in the high grade Wenban5 material) are refractory. Thus the Iceberg is more comparable to Barrick's Pipeline deposit that NuLegacy's COO, Dr. Roger Steininger discover back in 1989.

"A gram of oxidized gold within 500 feet of surface is worth more then 5 grams of sulphide/refractory gold below a 1,000 feet".

Cautionary Notes:

- Currently, there are no known NI 43-101 resources or reserves on the Iceberg deposit and there are no assurances that additional exploration will confirm the existence of an economic resource.

- Save for preliminary one hour "tumble leach in cyanide" tests conducted by American Assay Labs using previously assayed oxidized Horse Canyon-Wenban contact horizon material from recent core drilling (which demonstrated high average recoveries of 74.5% within a range of 64.4% to 89.2%), NuLegacy has not conducted a preliminary economic assessment or other study on the Iceberg Deposit and it is too speculative geologically to apply economic considerations to the Iceberg Gold deposit at this time.

- The close proximity and similarity of the Iceberg deposit to Goldrush or other nearby gold deposits including Pipeline is not necessarily indicative of the gold mineralization in the Iceberg deposit.

- The scientific and technical information contained herein has been approved by Dr. Roger Steininger, CPG 7417, NuLegacy's chief operating officer and a qualified person as defined by Canadian National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Albert J. Matter, July 2015